What's the Real Depreciation Curve of a GPU? It Depends on What It Actually Did.

Why telemetry-based monitoring reveals the real depreciation curve depends on actual workload, not industry averages.

The Debate Everyone's Having

There's a lot of discussion right now about how long GPUs last. Everyone seems to have a different answer:

- CoreWeave publicly assumes ~6 years of useful life

- Nebius pegs useful life closer to 4 years

- Some analysts and investors warn it might be ~3 years or less under heavy use

- If it were up to Michael Burry, it'd probably be 6 months before the AI hardware bubble collapses

The truth is, everyone is wrong because they're all using averages. From the telemetry patterns we see while working with lenders in the space, it's clear that identical GPUs can age very differently depending on workload, thermals, and utilization profiles.

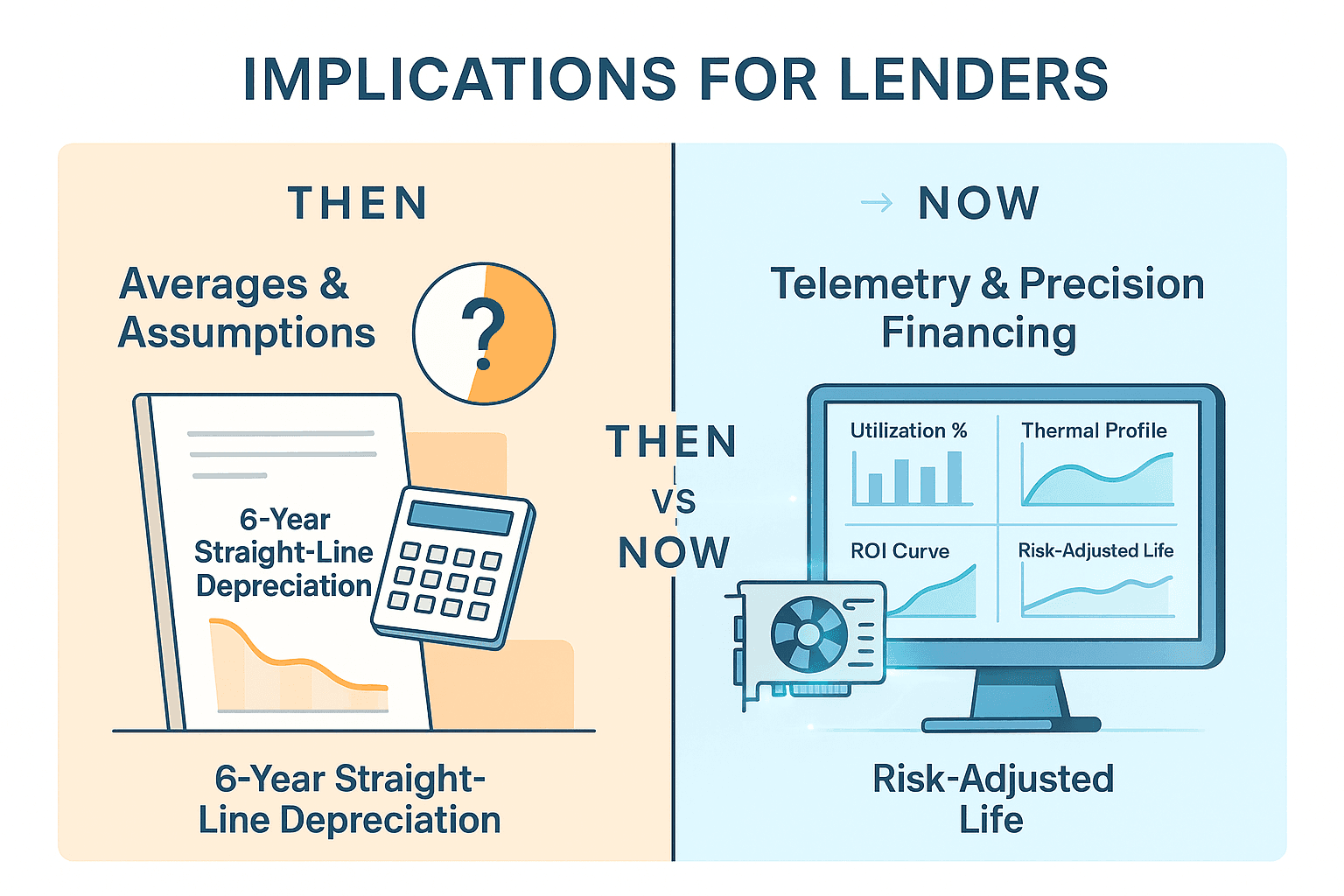

The old world runs on averages. The new world runs on telemetry.

Why the Old Model Fails

Today, most GPU financing deals assume a uniform, one-size-fits-all depreciation curve. The underwriting might go something like:

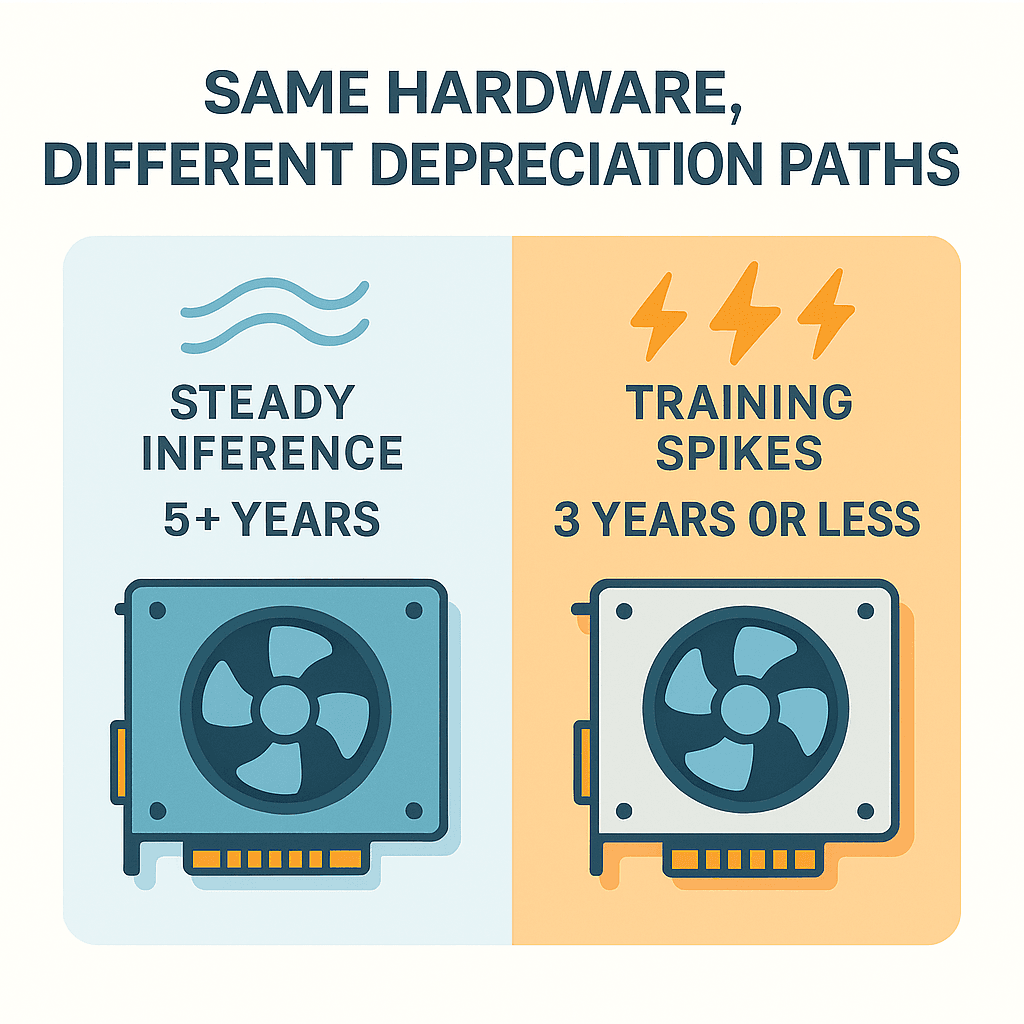

That assumption treats a GPU like a truck or an oil rig on a straight-line schedule. But GPUs don't age like trucks, servers, or drilling equipment. Identical GPU hardware can age very differently depending on how it's used:

- A GPU running steady inference at, 60–70% utilization, under moderate thermals, day in and day out

- vs. a GPU running irregular training workloads that repeatedly spike to 95–100% utilization and push thermal limits every afternoon

On paper these two might be the exact same model of GPU. In practice, their aging is radically different. One might still be going strong and profitable after 5+ years (indeed, some 2016-era GPUs are still in active cloud service), while the other might effectively be worn out - or at least no longer economically viable in 3 years or less.

Yet today many lenders underwrite both the same. They assume a uniform depreciation schedule regardless of workload. This leads to:

- Incorrect salvage value assumptions (overestimating how much a heavily used GPU will be worth in 4–5 years)

- Negative leverage – debt pricing that overshoots the asset's true income potential (the cost of financing can exceed the asset's ROI if life is shorter than expected)

- Increased lender exposure if utilization assumptions are wrong (lenders holding the bag on hardware that wore out faster)

- Borrowers stuck with covenants and loan terms designed for fantasy workloads, not their real use case

In short, financing GPUs on simplistic average assumptions can misprice risk by a wide margin. Averages hide the extremes. And in a fast-evolving market like AI infrastructure, the extremes matter.

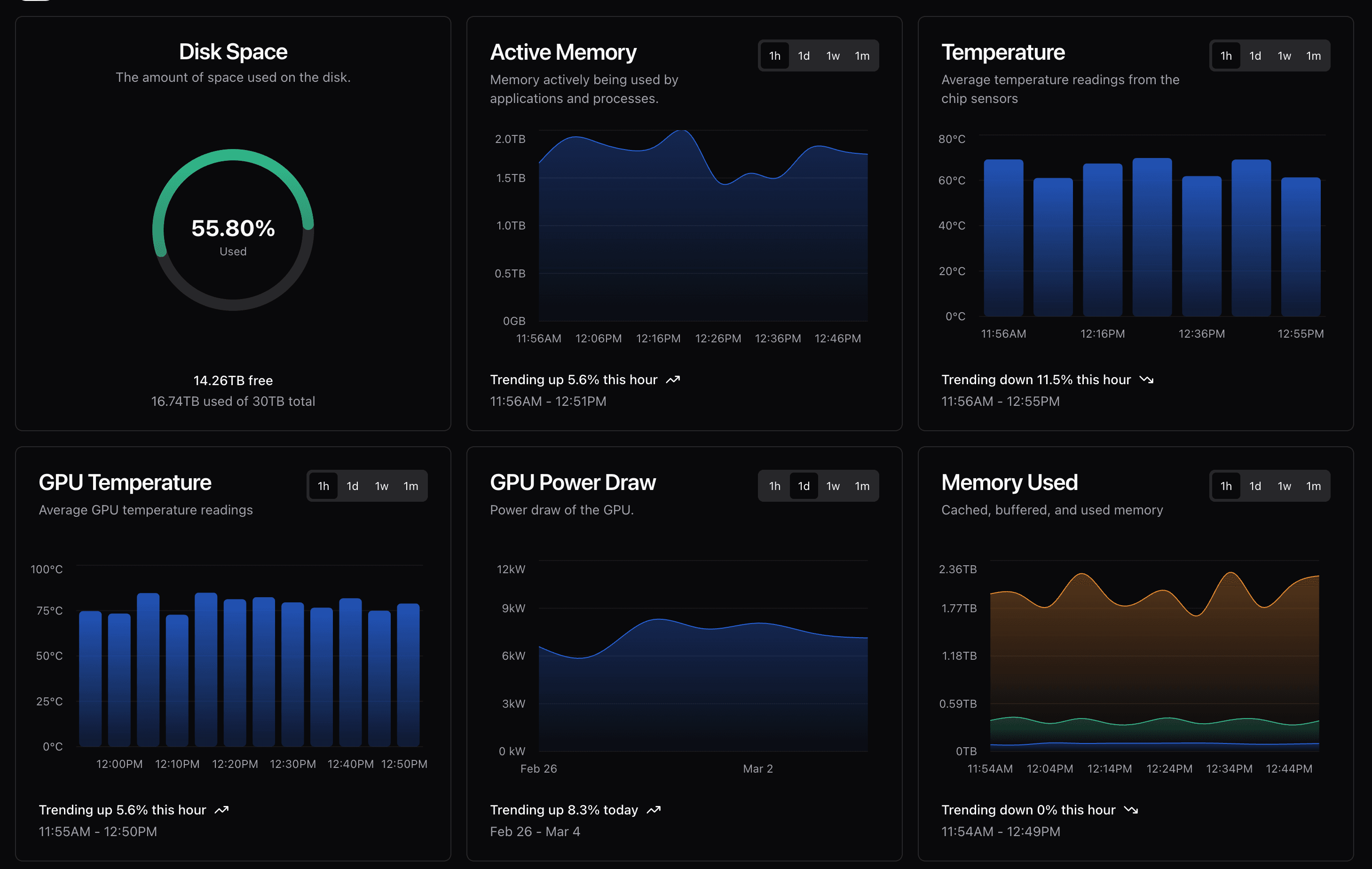

Example Aravolta telemetry dashboard showing real-time GPU utilization, memory usage, temperature, and power signals. This is the level of hardware-level visibility lenders and operators use to compare expected workloads against how assets are actually being driven in production.

What We Found in the Field

Consider a mid-market lender financing several GPU deployments in the 0–50MW range (hundreds of high-end GPUs across multiple customers).

Their original underwriting assumed:

- ~80% steady utilization on each GPU (a consistent workload level)

- ~5.5 year useful economic life for the GPUs (before resale or obsolescence)

- No meaningful variance across different customers or workload types (every GPU in the fleet treated uniformly)

But when real telemetry data was collected at the GPU level, here's what was actually observed:

| Factor | Expected (Underwriting) | Actual Observed Impact |

|---|---|---|

| Workload intensity (spikes to 95–100%) | "Occasional" spikes assumed | Happening daily - frequent max utilization spikes causing accelerated component stress and wear |

| Thermal envelope violations | Not modeled (assumed nominal) | Frequent during training bursts - many GPUs regularly ran above recommended thermal limits, reducing lifespan expectancy |

| Maintenance cycles (downtime, repairs) | Flat schedule (routine only) | Elevated needs under high-variance workloads - fans, thermal paste, and other components required maintenance sooner under punishing loads |

| Economic vs. physical obsolescence | Assumed identical timeline | Economic obsolescence ~18–30 months earlier for some workloads - i.e. GPUs became uneconomical (too slow or power-hungry per $ of output) long before they actually died |

Result: The fleet's effective depreciation curve varied by 30–45% across different end-customers, even though the GPUs were identical models. In other words, certain customer workloads drove their hardware to lose value almost half again faster than others.

To put it in perspective, one cohort of GPUs that was expected to last ~5.5 years of useful life was trending toward more like 3.7 years under real use. This nearly two-year gap in effective life versus expectation has cascading effects on salvage value, loan terms, covenant triggers, and the overall debt vs. equity mix.

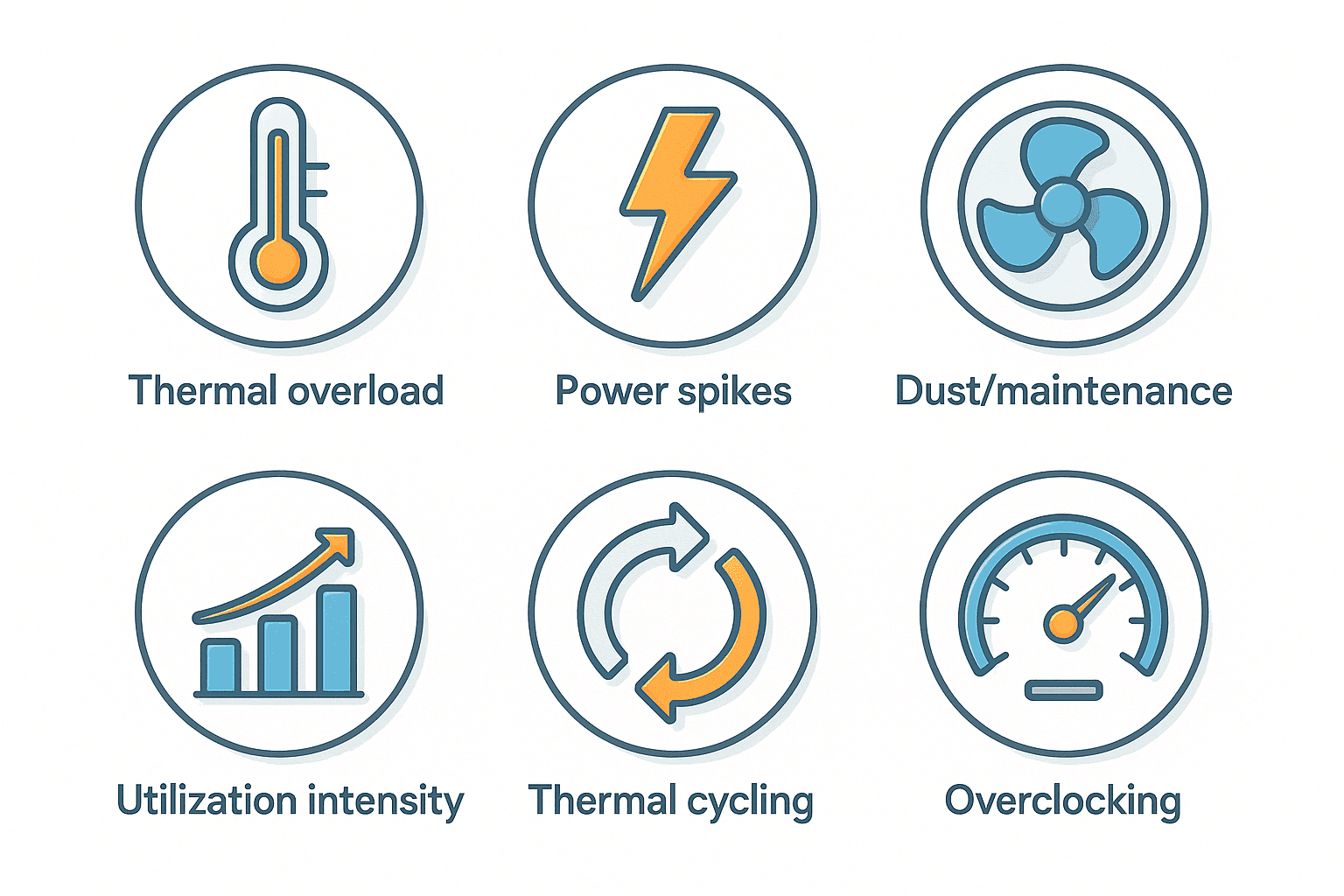

Key Factors and Events That Impact GPU Lifespan

Different operational events and stressors affect how fast a GPU "ages" or loses reliable performance. Thermal stress, power stress, and workload intensity are chief among them:

| Stress Factor | Description | Impact on Lifespan |

|---|---|---|

| Sustained High Utilization | GPU running near full capacity continuously (24/7 ~98% load) | Accelerated wear of components. Industry data indicates that at ~60–70% average utilization, top data-center GPUs may only last 1–3 years. |

| Thermal Overload | Frequent overheating events (85°C–100°C), causing thermal throttling | Major lifespan reduction. For every 10°C increase in operating temperature, electronic component life is roughly cut in half. |

| Power Spikes | Sudden surges in power draw or supply fluctuations | Power spikes strain voltage regulators and capacitors. High-end GPUs can surge past 500W. Repeated surges cause electromigration and long-term wear. |

| Thermal Cycling | Frequent on-off or load variance cycles | Repeated heating/cooling causes materials to expand and contract, stressing solder joints. Bursty workloads accelerate failure vs. steady 24/7 use. |

| Inadequate Maintenance | Dust buildup, aging thermal paste, worn fans | GPU fans last ~5 years but fail sooner under constant high RPM. Regular cleaning, fan swaps, and paste renewal (twice yearly) are essential. |

| Overclocking/Overvolting | Running GPU beyond factory specs for extra performance | Sharply increases power draw and heat. Even small overvolt accelerates thermal stress. Trades short-term speed for years of reliability. |

Sample GPU health and performance metrics generated within Aravolta — including temperature, power draw, memory behavior, and utilization trends. These workload signatures make it clear why identical GPUs can diverge in lifespan depending on how they're operated day-to-day.

The Pattern

The core question for GPU asset longevity isn't:

It's far more specific:

In other words, identical hardware ≠ identical useful life. Two GPUs that rolled off the same factory line can have drastically different economic lifespans depending on whether they lived a pampered life or a punishment test.

Telemetry is the new truth. Granular, real-time data about how each GPU is actually operating is the key to understanding its true depreciation curve. It moves us from debating generalities to quantifying specifics.

Implications for Lenders

If you are financing GPUs and your underwriting doesn't include telemetry-based, asset-level monitoring, you are likely missing the single biggest risk in the category:

1. Losing principal without warning

If a borrower overruns their GPUs with constant 90–100% utilization and high thermals, the hardware can economically die far earlier than your model assumes. A fleet underwritten for 5–6 years may effectively have only 2–3 years of economic runway, leaving you under-collateralized and over-leveraged.

2. Overpricing some deals

You'll charge too high a rate on borrowers who manage their GPUs well. Good operators running steady, optimized workloads will have longer-lasting hardware. They'll resent being overcharged and seek cheaper capital elsewhere.

3. Underpricing other deals

You'll take on extra risk where GPUs are being run to death. Without telemetry, that risk hides in plain sight until it causes surprise write-downs. You end up under-collateralized and under-compensated.

4. Leaving money on the table with deal structure

Granular data enables creative financing structures like sale-leasebacks with performance triggers, or usage-based financing where payments flex based on actual GPU-hour utilization. Without data, you're forced into conservative, inflexible terms.

Where Things Go From Here

The next generation of compute financing is being built right now. Lenders and operators no longer need to fly blind or rely on industry folklore for GPU longevity. We now have the tools to monitor GPU fleets at the hardware-signal level, in real time, and produce real depreciation curves tailored to each workload and environment.

We're working with forward-looking financiers and mid-market operators (in the 1–100MW segment) to support innovative structures like sale-leasebacks, usage-based leases, and revolving GPU credit lines – all anchored by actual performance data. It's lending based on actual risk, not averages.