Verifying GPU-Backed Credit Positions with Real-Time Infrastructure Data

USD.AI uses Aravolta for continuous, infrastructure-level verification of GPU-backed credit positions.

Aravolta enables us to offer smarter, more agile financing solutions. They bridged the gap between our risk requirements and the technical reality of the data center, allowing for collateral auditing without creating operational friction for our infrastructure partners.

GPU-backed credit introduces a new class of collateral: high-value, physical compute infrastructure.

Unlike traditional assets, GPUs cannot be verified through paperwork alone. Their value depends on whether they are:

- Installed as described

- Operational over time

- Continuously accounted for

USD.AI's approach to GPU-backed credit is built around a simple principle: Verify, don't trust.

That principle requires real-time, infrastructure-level data, not periodic reports or self-attestation.

Traditional Verification vs. Aravolta

A fundamental shift in how GPU collateral is verified.

Traditional Approach

- Quarterly PDF audit reports

- Trust-based self-attestation

- Manual spreadsheet tracking

- Point-in-time snapshots

- Weeks to verify asset changes

- High operational risk exposure

With Aravolta

- Real-time API data feeds

- Automated infrastructure verification

- Continuous telemetry monitoring

- Live operational status

- Instant asset change detection

- Verifiable audit trail

This limits how confidently GPU-backed credit positions can scale. Until now.

Verification Scope

All monitoring is performed at the infrastructure layer only.

Verified

- Physical presence of servers and GPUs

- Asset identity, serial numbers, and configuration

- Operational health and status

- Continuous availability over time

Not Collected

- Customer workloads

- Model or application data

- Tenant-specific usage information

- Application performance metrics

Collateral visibility remains concrete, continuous, and auditable without compromising customer confidentiality.

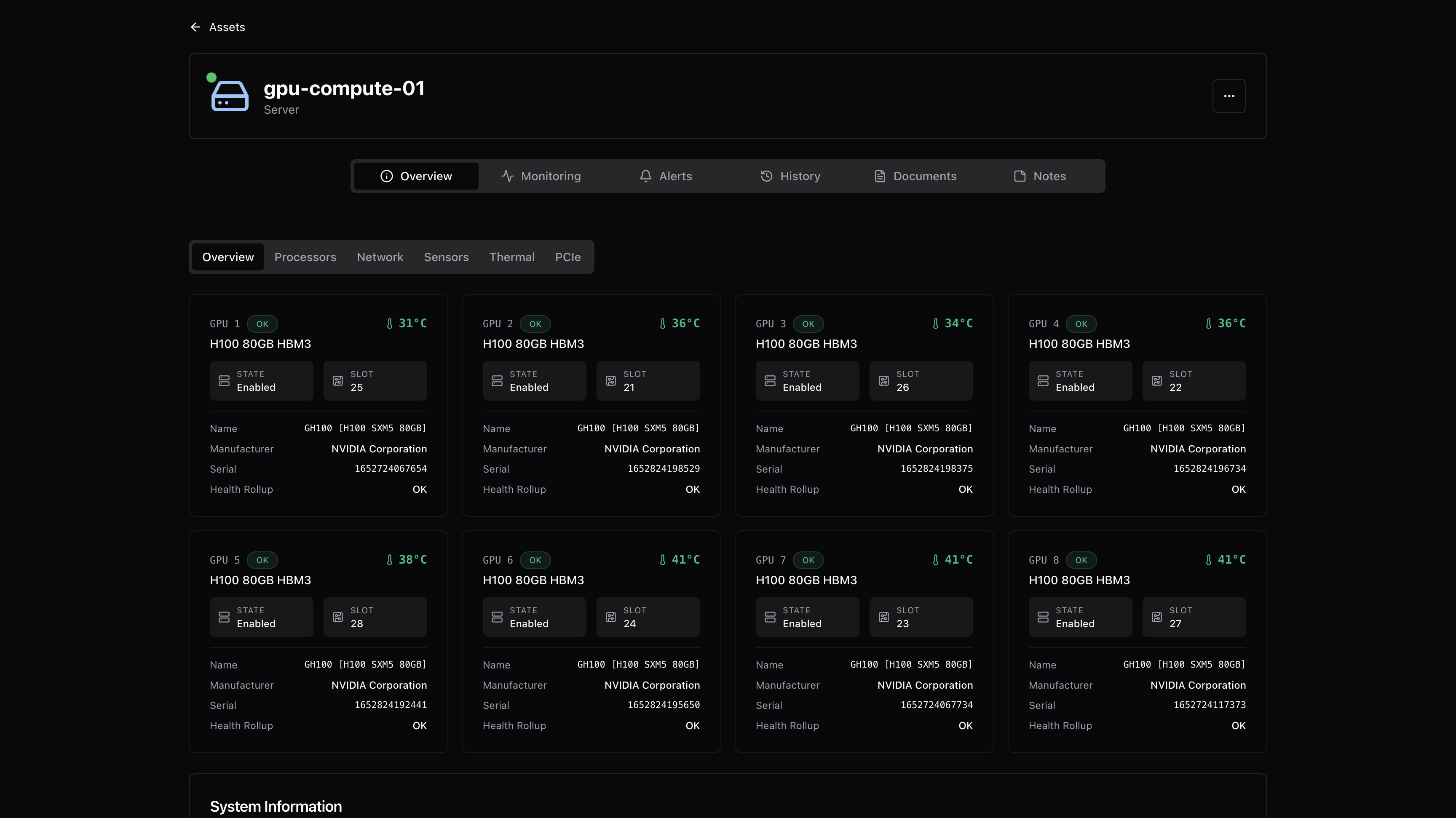

Server-Level GPU Verification in Action

GPU Identity

H100 80GB HBM3 verified by serial number

Health Status

Real-time OK/fault status per GPU

Thermal Data

Live temperature monitoring

Server Context

Dell PowerEdge XE9680 identification

Why Server-Level Data Matters for Credit

Continuous Confirmation

Collateral exists and remains active in real-time

Auditable Records

Infrastructure records tied directly to credit positions

Reduced Trust Reliance

Replace trust-based reporting with verified data

For lenders, this turns GPUs from opaque hardware into verifiable financial assets.

The Transparency Layer

Aravolta sits between physical infrastructure and credit protocols, providing continuous verification without touching workloads.

GPU Hardware

H100s, serial numbers, health data

Aravolta

Infrastructure-level verification

USD.AI Protocol

Credit positions, lender dashboards

Real-Time Visibility

Collateral visibility is real-time instead of episodic

Live Infrastructure Data

Replaces trust assumptions with live infrastructure data

Scalable Verification

Supports scalable verification as credit positions grow

The result is a lending structure where verification is ongoing, not event-driven.

Book a time to speak with our infrastructure team.